Habitat homebuyers help build their homes alongside community volunteers and pay an affordable mortgage. All household members 18 years and older are required to participate in some form of “sweat equity” – our homebuyers complete 250 hours per head of household. This helps them build their future home and take homebuyer education courses to prepare them for success. As a result, our homebuyers thrive in their homes with a total foreclosure rate of 0% since our inception.

Why purchase a home with Habitat?

The high cost of housing in the San Gabriel Valley means that homeownership is out of reach for many families. With the support of community partners, donors, and volunteers, SGV Habitat constructs new homes and renovates existing homes alongside Habitat Partner Homebuyers. We work to create affordable homeownership opportunities so everyone can achieve strength, stability and self-reliance through shelter.

San Gabriel Valley Habitat for Humanity sells affordable homes to low-income, first-time homeowners to help them achieve the American dream of homeownership. Approved homeowners, at time of purchase, qualify for a monthly housing payment (mortgage, property tax, insurance, HOA fee—if applicable) equal to 30% of their gross monthly income.

homeownership application period closed

Johnny and Nely's path to SGV Habitat homeownership

Where can my home be located?

We currently serve families in more than 31 communities in the San Gabriel Valley, including areas of Los Angeles and Pasadena – an area that covers over 400 square miles and more than 1.8 million residents.

We are unable to guarantee a specific location for your future home. If you are accepted into our homeownership program, you must be willing to purchase an available home within our service area. The area we serve includes, but is not limited to:

- Alhambra

- Azusa

- Bradbury

- El Monte

- Glendale

- La Canada

- Monrovia

- Pasadena

- Rosemead

- San Marino

- Temple City

- Arcadia

- Baldwin Park

- Duarte

- South El Monte

- Irwindale

- Los Angeles (Atwater, Eagle Rock, El Sereno, Highland Park, Lincoln Heights and Monterey Hills)

- Monterey Park

- South Pasadena

- San Gabriel

- Sierra Madre

Unincorporated Areas:

- Altadena

- Montrose

- La Crescenta

- Sunland-Tujunga

Am I eligible?

- You must demonstrate a need for housing. This means that your current living conditions are substandard, crowded, or overly expensive.

- You must demonstrate ability to pay for your new home by having good credit (no recent bankruptcies, collections, liens, or judgments) and meeting annual income requirements.

- You must be willing to partner with us by completing homebuyer education and investing sweat equity hours building your future Habitat home and the homes of other Habitat Homebuyers.

- You must meet the definition of a first-time homebuyer.

What are the income requirements?

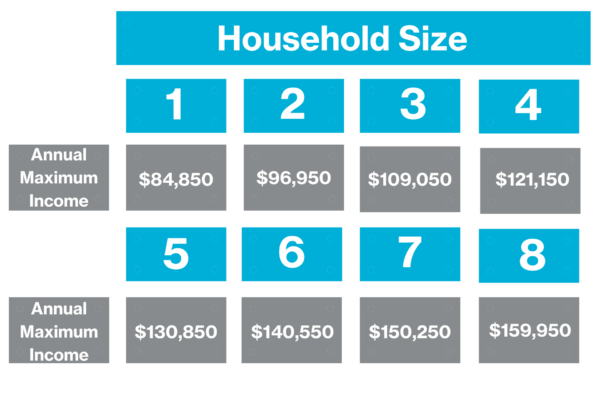

You must earn at or below the income listed for your household size. These limits are based on the 2025 Los Angeles County gross (before taxes) annual income figures and are subject to change.

What to expect

- Submit a Pre-Application

- Submit a Full Application

- Application Screening

- Additional Screening

- Partnership Agreement

- Move In!

When you submit a pre-application, we will confirm your household meets our basic program guidelines. The main areas we will review are income, credit, and confirming you are a first-time homebuyer. Submitting a pre-application does not guarantee qualification for our program or an invitation to submit a full application.

If you have questions about the pre-application – please contact us or attend one of our information sessions.

Qualified applicants who submitted a pre-application in our open application period will receive an invitation to submit a full application based on a random processing order.

Initial income and credit qualification will be completed by staff to determine eligibility.

Completed applications that meet initial income requirements will more forward to credit, criminal background, employment, and tenancy verifications. We will also have a meeting (currently occurring virtually) with the applicant and co-applicant if applicable.

Applicants approved for the program based on their ability to pay, need for housing, and willingness to partner, will sign a Partnership Agreement and begin completion of pre-purchase requirements.

After completing homebuyer education, sweat equity, and down payment savings requirements, you will have the opportunity to receive an affordable mortgage, complete the escrow closing process, and move into a Habitat home!

Homeownership FAQ

Does SGV habitat provide emergency housing assistance or rental assistance?

No, but we can refer you to other programs that may be able to assist you.

How long does the process take?

How long the process takes varies from applicant to applicant. Generally, the process from submitting a pre-application to signing a partnership agreement takes approximately 6 – 8 months. It could take longer depending on Habitat’s volume of pre-applications and other factors, such as the completeness of the documentation you provide. Ideally, once you sign a partnership agreement you will be able to do some sweat equity on the home you will eventually live in and move into that home within one year, although it may take up to 18 months depending on the availability of a home that meets your needs and how quickly you’re able to complete your pre-purchase requirements.

SGV Habitat does not conduct in-person interviews nor assessment of current housing conditions. Applicants are asked to complete a self-survey of current housing conditions and provide photo documentation.

Why do you pull my credit?

Your credit report gives us a good indication of whether you have the ability to afford a mortgage payment on top of your existing financial responsibilities. We are looking for a history of consistent, on-time payments of your existing bills. We are also looking to make sure there are no major issues, such as a history of late payments, open collections, or open bankruptcies. We encourage you to apply, no matter your current credit score.

Notes: We will check your credit at the beginning of the full application process and shortly prior to home purchase to confirm continued eligibility for our program. If no credit history is available, SGV Habitat will work with applicants to determine a history of on-time payments and how to build a credit history.

Can I sell the house?

To help make sure that we are selling to households that need a home to live in and not investors, you can only sell the home if you first offer to sell the home to Habitat (and sometimes a city or county that provided funding to build your home) and you can only sell it at an amount so that it remains affordable to qualified buyers.

What are the sweat equity requirements?

We require 250 hours of construction Sweat Equity per adult household member. The completion of Sweat Equity can take from 3-12 months. Buyers must also attend Homebuyer Education sessions appropriate to their future home (approximately 50-60 hours).

If adult members who will be living in home have physical limitations, for example mobility issues, another adult member of the same household can contribute to their sweat equity hours. Applicants are ultimately responsible for ensuring all sweat equity hours are completed on time.

SGV Habitat does not ask anyone to complete tasks beyond their physical and/or mental capacity, and persons living with a disability are welcome on site provided they are able to follow safety guidelines. Habitat volunteer sites provide a safe and supportive environment for anyone willing to try or learn a new skill.

Do i have to be a U.S.. citizen to apply?

San Gabriel Valley Habitat does not have a residency requirement, but some 3rd party financing and down payment assistance sources may require proof of legal U.S. residency status for buyers.

How much will my mortgage payment be?

Your mortgage payment (including principal, interest, taxes, insurance, and any homeowner’s association dues) on your affordable first mortgage will be no more than 30% of your gross monthly income – AT TIME OF PURCHASE. Our current Habitat mortgage doesn’t change over time, but your property taxes, homeowner’s insurance, and HOA dues will likely increase after the first year.

Can I rent my home to other people?

No, Habitat homes must be owner-occupied and cannot be rented out.

Do I have to be employed to qualify?

No, but proof of income from all sources for every adult household member will be required. Documentation showing a stable and reliable source of income is required.

How does habitat decide where to build? Can I ask for a specific location?

SGV Habitat builds wherever possible and we have a history of improving neighborhoods where we build. Homebuyers are offered at least one home for purchase suitable for the household size and income at time of purchase. Participants in our Homeownership Program must be willing to purchase a home within our service area.

Our homes, just like any market home, are in varying neighborhoods based on availability. The purpose of affordable housing is to improve communities.

What is the definition of a first-time homebuyer?

To qualify for our homeownership program, you must meet the definition of a first-time homebuyer:

- An individual who has had no ownership in a property or principal residence within the last 3 (three) years.

- Is not on title or own another home or property

- A single parent who has only owned with a former spouse while married.

- An individual who is a displaced homemaker and has only owned with a spouse.

- An individual who has only owned a principal residence not permanently affixed to a permanent foundation (mobile home, trailer, vehicle, etc.).

- An individual who has only owned a property that was not in compliance with state, local, or model building codes and which cannot be brought into compliance for less than the cost of constructing a permanent structure.

- Has experienced displacement through no fault of their own. Examples: disaster, government action, termination of tenancy, domestic violence, witness protection program, hate crimes, inaccessibility of unit, substandard housing, homelessness.

What if I am denied?

If an application is denied, applicants are provided with a written explanation of the reasons for denial. This information is required by law and we hope it will help you in the future. Situations and needs change. If you aren’t selected this time around, we welcome you to apply again in the future.

Other income information

CURRENT RENTERS: If you are a renter, the current rent must be included in the debt to income ratio to determine if you are currently cost-burdened or if assuming a mortgage will put you at risk of overextension.

INCOME LIMITS: SGV Habitat looks at pre-tax income. If you are self-employed, this is net income. Otherwise, it is gross income from all sources.

CO-APPLICANTS: Please check with a tax or finance professional to determine the best option for you.